Imported Services refers to the services that are made by a supplier that is not located inside Malaysia to a

recipient who is located in Malaysia and such services are consumed in Malaysia.

The following are sample transactions that involves services from overseas into Malaysia.

Note:

1. Make sure the IM0-SVC tax code has been created with the following settings.

2. Make Sure TX-SVC tax code is set accordingly.

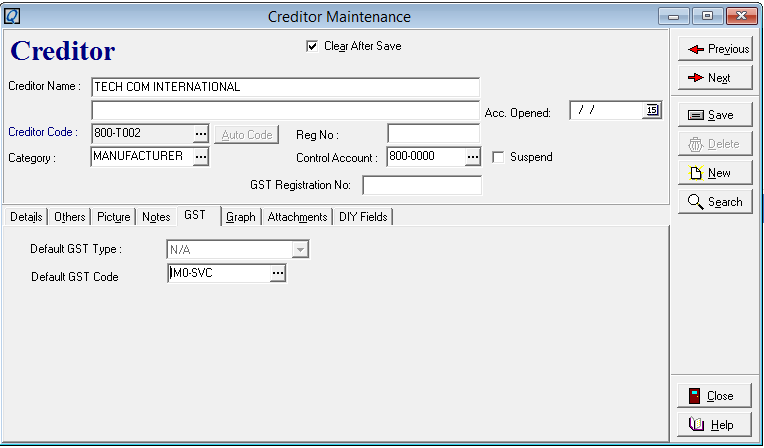

3. Kindly ensure that the Default Tax Code for the overseas service provider is set to IM0-SVC.

Purchase Invoice (*when receive Invoice from overseas service provider)

1. Kindly ensure the GST Tax Code is “IM0-SVC” and the Tax class is “Imported Services”

Journal of the PI from overseas supplier.

Journal of the PI from overseas supplier.

Pay Bill to overseas service provider

1. In Pay Bill screen, right click and select “Payment For Imported Services”

2. Select the related record and in To GST Tax Code field, select “TX-SVC”. Then, click on OK

Note the Pay Bill screen. When selecting the particular bill, the word “Imported Services” will appear.

Journal of the bill.

Refer attachment for details

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article