Brought forward balance leave with payroll is necessary for company that allows employee to bring forward balance leave from previous year. Read on to learn how.

Scenario

If any of your Leave Type is eligible to be brought forward, please remember to perform Leave Year End to update the Brought Forward Leaves to next year’s Leave Opening.

Solution

First of all, to Brought Forward Balance Leave with Payroll, you need to enable leave type that your company is allow to brought forward.

Setup Leave Type that allows it to be brought forward

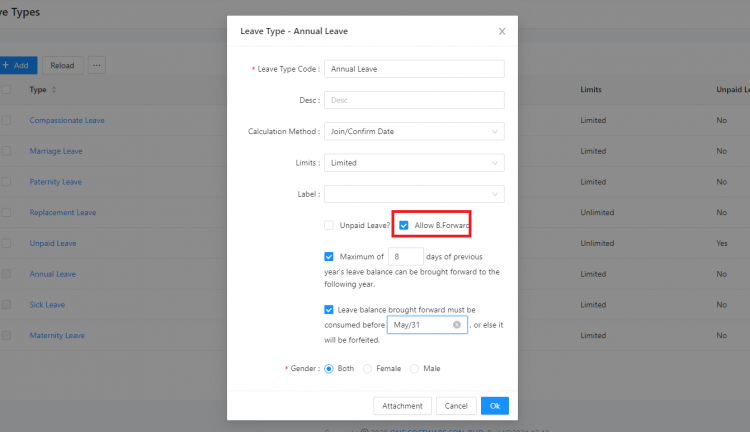

1. At Human Resources > Leave Type, click on the Leave Type that you want to set as a B/F leave.

2. Clicks on Allow B.Forward checkbox > select your restrictions on the maximum days allowed to carried forward and the expiration date (if any).

* If you have a different expiration date every year, please only update the brought forward leave’s expiration date on the year itself.

For example, if your expiration date for Year 2021 is on March 31, you should update the expiration date in the year 2021 (before Leave Year End). If 2022’s expiration date is May 31, update the date when you reach Year 2022 only.

Brought Forward Balance Leave with Payroll using the Leave Year End feature

Leave Year End is the process of calculating and bringing forward the employees’ leave balances that are set up to be carried forward to next year.

To Brought Forward Balance Leave with Payroll, please expand Human Resources, click on Leave Year End.

1. You can Process each employee individually by selecting the Leave type here and click on Process. A successful message will prompt.

Click OK to confirm

2. You can also click on Batch Process to perform Leave Year End to all your employees in just a few clicks.

3. An Employee list will prompt. You may select all employees or just simply select employees that are eligible.

4. Click OK > OK again to confirm

5. A successful message will prompt for completed process

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article