Scenario:

Match Appreciation and Depreciation Account in Cloud Accounting System to display the book value of the Fixed Asset account correctly in Balance Sheet Report.

Solution

Most fixed assets will decrease in value because of aging, wear and tear, economic factors and depletion. Therefore, business tries to show what the estimated current value is by working out on how much the assets have reduced, which is known as depreciation.

Recording of depreciation provides the information about the current book value of the fixed assets. In QNE Cloud Accounting, depreciation entries may be recorded through Journal Voucher form. Yet for a start, in order to later run a Fixed Asset Report with greater accuracy, Fixed Asset account must be first paired with its corresponding Accumulated Depreciation account.

Go to Navigation Pane > General Ledgers > Assets and Depreciation.

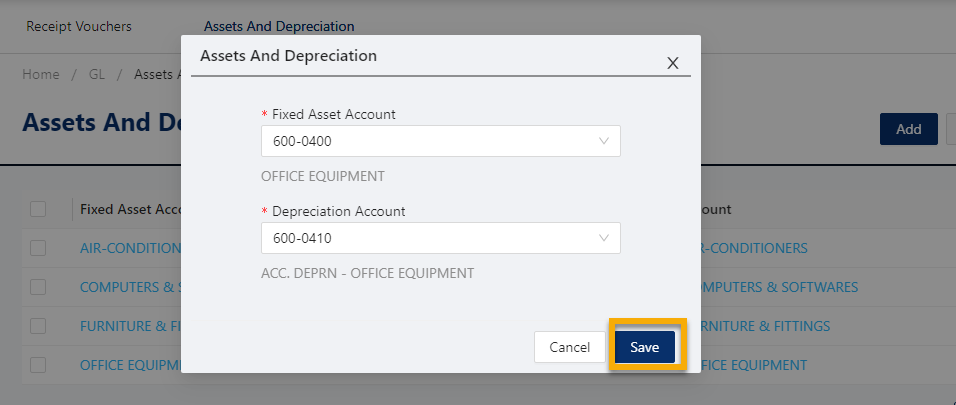

Click ‘Add’ to start pairing your accounts.

The form asks to pick the Fixed Asset Account and its corresponding Accumulated Depreciation Account, among all those GL Accounts pre-encoded under Fixed Assets Account Type in your Chart of Accounts.

Browse the GL Accounts using the dropdown fields, then click ‘Submit’.

Continue to match until all fixed assets have been paired.

If you wish to update or modify the matched accounts, click the specific item row.

Apply any preferred changes, then click ‘Submit’.

To remove or delete the paired accounts, select the account pairs you wish to delete and click ‘Delete’ button at the upper right corner of the screen.

To proceed with deletion, click ‘Yes’ from the message prompt.

The system will confirm for successful action.

Keep in mind that this action only removes the pairing or matching settings, not the GL Accounts.

The Accounts can only be associated with other Fixed Asset/Accumulated Depreciation Accounts after deletion on this screen.

To delete the actual GL Accounts, you may opt to go to Chart of Accounts screen. After saved, GL Journals may be viewed by clicking the provided icon in the screen.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article