Overview:

This guide provides steps to ensure accurate PCB (Potongan Cukai Bulanan) calculation for employees, covering scenarios where payroll is processed from the beginning of the year and when an employee joins mid-year or payroll starts mid-year.

Scenario:

Scenario 1: Employee’s PCB Is Updated Monthly from January

The employee has been with the company since the beginning of the year, and payroll has been processed continuously from January.

Scenario 2: Employee Joins Mid-Year or Payroll Starts Mid-Year

The employee joined the company after January, or the company only started using Cloud Payroll partway through the year, meaning previous PCB data is not captured in the new system.

Solution:

Scenario 1: Employee’s PCB Is Updated Monthly from January

You may refer to the steps below:

As per the information, this monthly PCB calculation does not require manual accumulation.

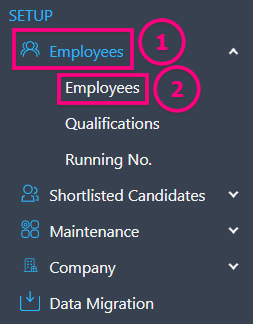

Step 1: Go to Employees > Employees

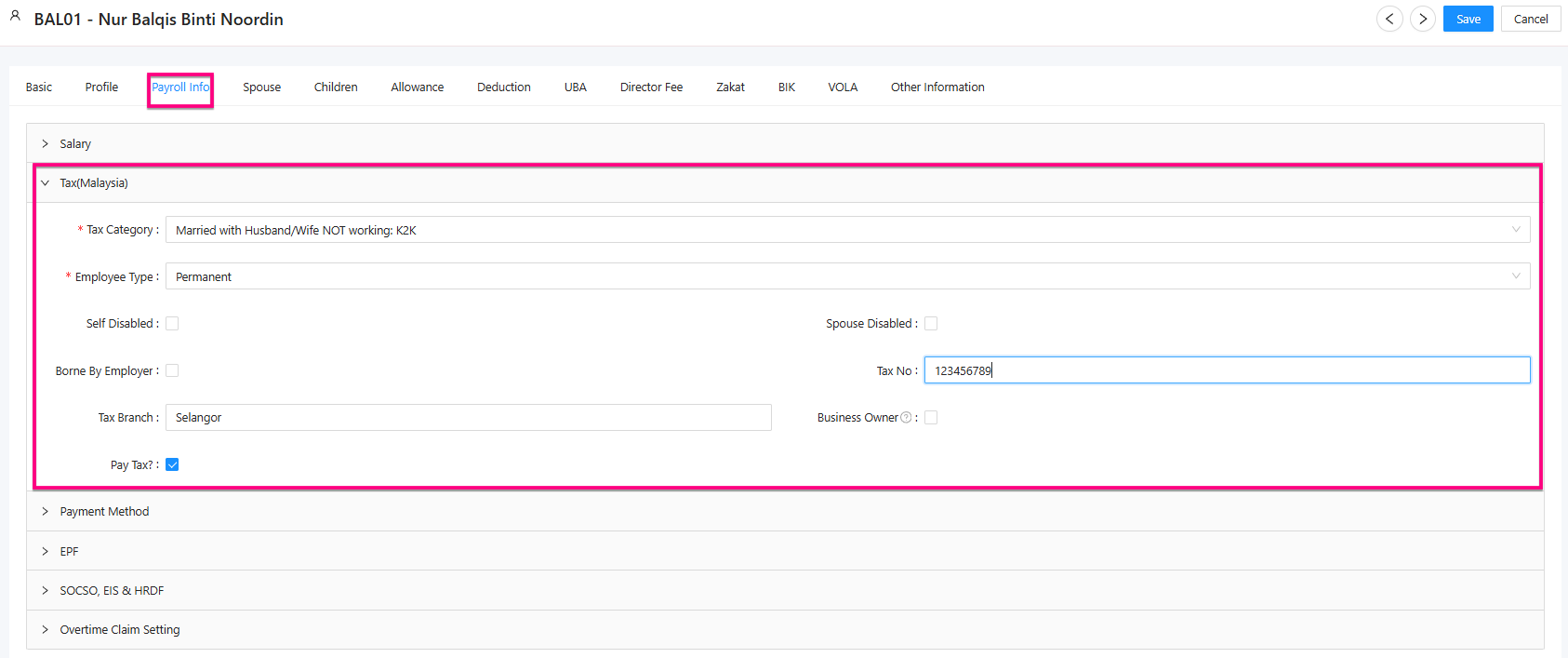

Step 2: Go to Employee > Payroll Info > Tax (Malaysia)

Ensure the Tax (Malaysia) information is updated correctly.

Notes: After completing the setup, you can proceed to generate payroll as usual each month.The system will automatically calculate the employee’s Income Tax (PCB/MTD).

Scenario 2: Employee Joins Mid-Year or Payroll Starts Mid-Year

You may refer to the steps below:

Based on the information provided, the system will compute PCB (Potongan Cukai Bulanan)using the total income from the start of the year until the current month. This ensures the correct tax amount is deducted and prevents underpayment or overpayment.

Notes: If you have worked at another company earlier in the year, make sure to update your previous income in the system. This ensures your monthly tax deduction is correct and prevents underpayment or overpayment.

Step 1: Go to Employees > Employees.

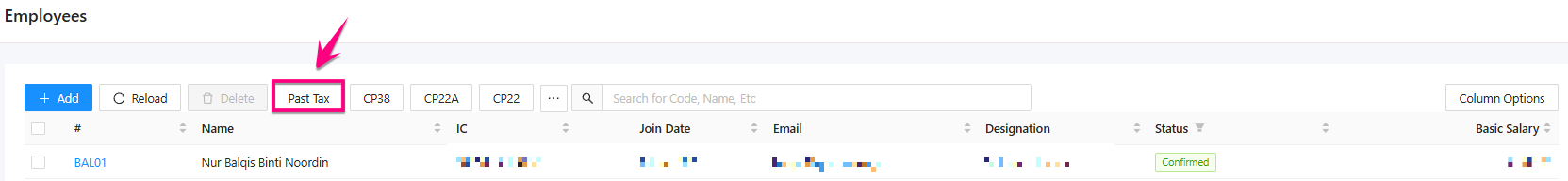

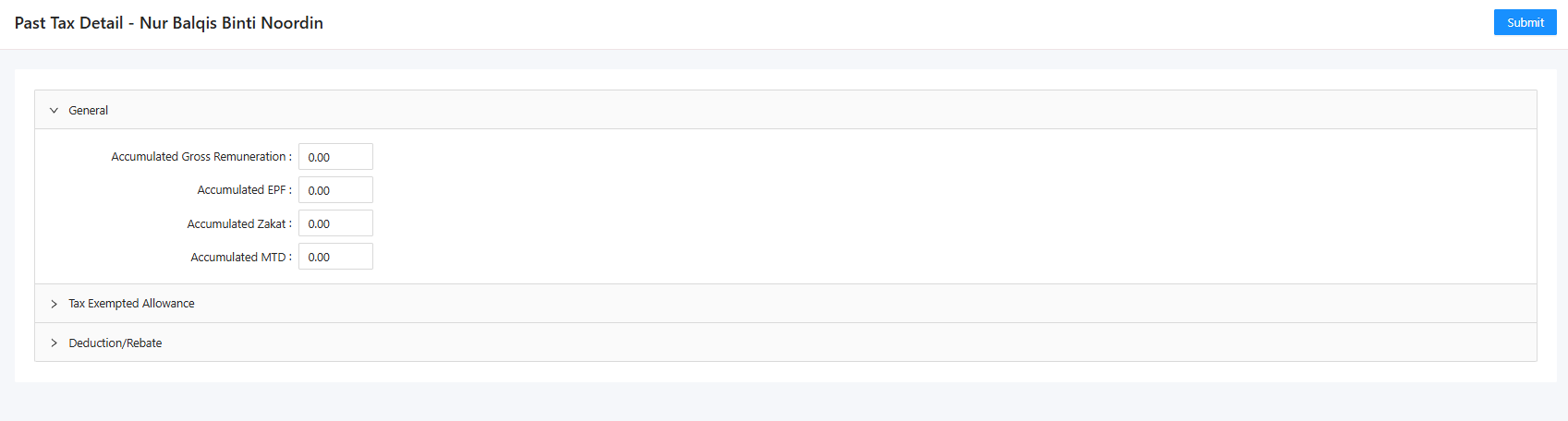

Step 2: Click on “Past Tax”.

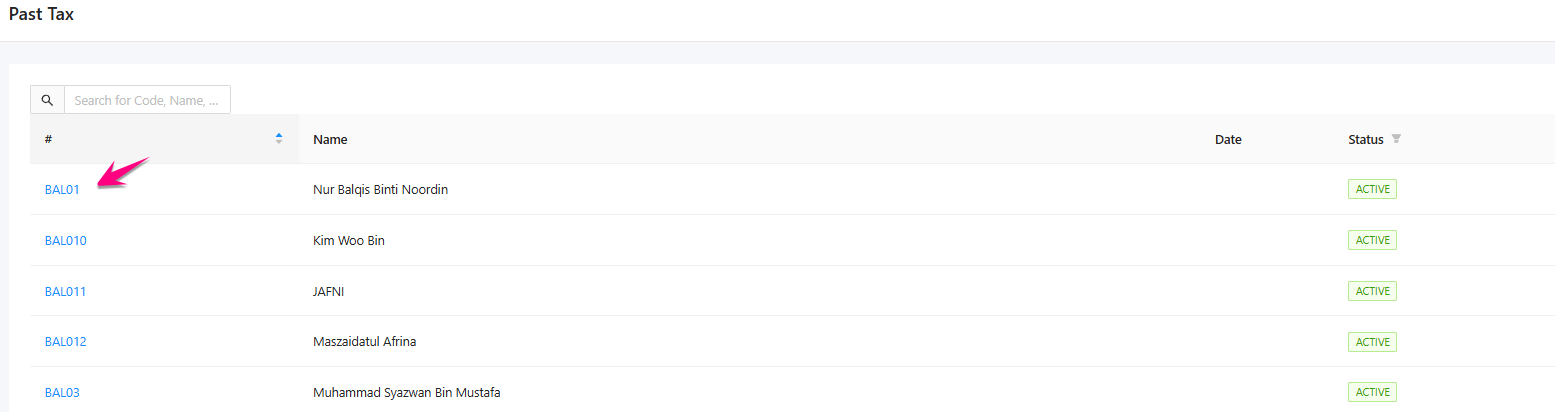

Step 3: Click on the Employee code for the staff member whose Past Tax information you want

to enter.

Step 4: Fill in the required information to ensure the Income Tax is calculated accurately.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article